Why set the target at $1 million? Achieving this goal is good as it could offer direction and the vision to pursue it that is mainly needed.

Introduction

In today’s lifestyle, people prefer financial independence as their main aim in life. Having one million dollars in your bank account is a delicious dream, in which most people see stability, freedom, and a prosperous future. But how can one be able to transform that idea into a reality? Unilever’s New CEO said, “‘How are you going to make1m.com? A stroke of luck doesn’t purely do earning or saving the first million. It involves being at the right place, planning for it, and most importantly, determination. Many of you surely have a certain goal – a sum you want to make, for instance, make1m.com. So, let’s leave imagination aside and consider how one is to make1m.com now to get the guarantee of securing your financial future.

Do You Have the X-Factor?

What Sets You Apart?

Do you possess something unique about yourself that categorically makes you different from the rest? This unique quality is sine qua non in your endeavor to make1m.com. The X-factor could be anything from having a particular skill, being a hard-working individual, or having an idea that can bring a large amount of extra income.

- Self-Awareness: Most importantly knowing our strengths and limitations.

- Determination: Persistent self-motivation: the trait, where an individual can stay motivated and not give up when faced with challenges.

- Innovation: More precisely, the ability to approach problems in a rather non-conventional, using a creative skills approach.

Why a $1 Million Goal?

Why set the target at $1 million? Achieving this goal is good as it could offer direction and the vision to pursue it that is mainly needed. People set such a financial goal because millions are considered a sufficient amount of money to achieve financial security and free from financial concerns in the future. However, it’s not about the money, or not only about the money, for what the money signifies – freedom from monetary concerns.

The Challenge of Making $1 Million

Understanding the Challenge

Not only the task is in the creation but also in the protection as well as increasing of such wealth. The question arises, given the fact that you already have a million-dollar contract, how are you going to make1m.com? It is a process, which requires foresight, restraint, wise allocation of funds, and reinvestment specifically in the enhancement of one’s knowledge.

Steps to Overcome the Challenge

- Set Clear Goals: It is very important to define what $1 million means to an individual and create realistic objectives.

- Create a Financial Plan: Financial planning is the strategic anticipation of all the income that you’ll have in the future and all the expenses, savings, and investments that you’ll make1m.com in the future.

- Diversify Income Streams: We should be able to have other sources of income apart from doing business in the most popular product. Play it safe by seeking other means of income such as having a side job, investing, and passive income.

- Invest Wisely: Find out more about various investment opportunities such as equities, real estate, fixed securities, and fixed investments, and invest with the right strategies.

- Monitor and Adjust: Check according to the plan you have made and try to adjust yourself according to the plan.

Strategic Planning for Success

Building a Financial Plan

A financial plan of action is quite similar to a financial strategy. It is your guide to achieving a million dollars. It should include:

- Income Sources: List all the possible ways of generating income including the main occupation, other business activities, and passive income.

- Budgeting: Put up a financial plan that makes you use less of your income for consumption and most of it for saving and investing.

- Emergency Fund: Build an ‘Emergency Fund’ which would consist of easily accessible and liquid cash for immediate and unforeseen expenses with minimum withdrawal from the investment fund.

- Investment Strategy: Determine the amount of resources that one wants to allocate in particular classes of capital such as stocks, bonds, and real estate amongst others.

Example of a Basic Financial Plan

| Component | Details |

|---|---|

| Income Sources | Salary, Freelance Work, Dividends |

| Budget | 50% Essentials, 20% Savings, 30% Leisure |

| Emergency Fund | 6 Months of Living Expenses |

| Investment Strategy | 60% Stocks, 30% Bonds, 10% Real Estate |

Diversifying Income Streams

A single source of income is always dangerous. That is why it is always wise to seek other sources of income as it enhances your likelihood of gaining $1 million. Consider these options:

- Side Hustles: Do paid work on the side or self-employ yourself depending on what the interest is.

- Passive Income: They should invest in dividend shares, rental houses or apartments, P2P businesses, and other similar investment models.

- Online Opportunities: Sell your competencies, either in the form of courses or e-books or even through affiliate marketing.

The Role of Smart Investments

Types of Investments

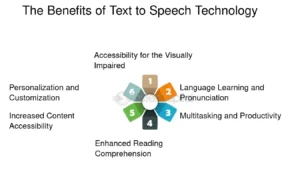

Savings are an adventitious tool in increasing the wealth base towards arriving at the $1,000, 000 mark. Here are some investment options:

- Stocks: The stock market is arguably one of the most rewarding investment opportunities markets today are full of risks

- Real Estate: One might think that getting a steady monthly amount of money and constant property value growth is possible only in real estate.

- Bonds: This means that bonds are safer than stocks since one is guaranteed to be paid back but the returns are lower.

- Mutual Funds/ETFs: These are investment sources that diversify one’s risk across various sources of investments.

Comparing Investment Options

| Investment | Risk Level | Return Potential | Liquidity |

|---|---|---|---|

| Stocks | High | High | High (if traded) |

| Real Estate | Medium | Medium to High | Low to Medium |

| Bonds | Low | Low | High (Government Bonds) |

| Mutual Funds/ETFs | Medium | Medium to High | Medium to High |

Investing in Yourself

Finally but very importantly do not neglect personal development. Education, quality, and social connection can lead to numerous possibilities that may increase your earnings considerably.

FAQs About Making $1 Million

How long does it take to make $1 million?

It will take years, perhaps decades, to generate $1 million, it depends upon your income, expenditure, rate of investment, and amount you invest yearly. If organized properly and with strict adherence to the schedule some accomplish this target in 10-15 years.

What are the risks involved in trying to make $1 million?

Chief among these risks is a market risk which is the fluctuation in prices of securities, and systemic risk, which emanates from the downturn in the economy and unsound investment decisions. One should always try to invest in many areas and have a plan B or C for safety purposes.

Can anyone make $1 million?

Of course, this can become possible by embracing the right attitude, planning, and working to make $1 million. But, it takes time, hard work, and commitment as well as some amount of risk-taking to make smart decisions.

What should I do after making $1 million?

Once you can reach that million mark, it is time to manage that wealth and even grow it. Still, fund it, seek for more expansion, and think of charity or contributing to society.

Conclusion

Making one million dollars is as hard as it is possible, but it will take some effort, planning, and determination. So, it’s pretty clear, regardless of talent or luck in owning an X-factor, everyone can achieve the goal If there is enough determination and a good financial basis. The point is to start pressing on the action today, and start the planning and investing on different income streams today. Just to recap, let me remind you of the fact that the main target is not to make1m.com, but to be able to get your financial freedom and have the liberty to do whatever you desire.